A Publication of the California Mortgage Association

Valuable Insights and Information About California Private Lending

Points of Interest is the California Mortgage Association’s newsletter providing readers with valuable insights and information on industry news, legislative updates, legal matters, compliance tips, and much more. All but the most recent issue are available to read below. If you would like to view the latest Points of Interest issue, please click here.

If you would like to write for us, please click here and fill out the interest form.

Fall 2023

Inside this issue:

- A Potpourri of Bankruptcy Issues for Lenders to Consider

- An Investor’s Guide to Private Licensing Requirements

- Foreclosure: The Mortgage Industry’s F-Word is Back in Style

- Lender Alert: LIBOR is Going Away. Are you Prepared?

- Bidding Strategies and Issues Under California’s Post-Foreclosure Auction Process

summer 2023

Inside this issue:

- Richard C. Temme Becomes “Honorary Lifetime Director”

- HDMA – The Temporary Financing Exclusion

- The Short-Term Rental Debate – What Investors Can Consider

- Why Should I Care About the Difference Between a Legal Parcel and an APN?

- Pros and Cons of Taking Title at the Foreclosure Sale Via an LLC

- Member Spotlight: Lori Bradford

Spring 2023

Inside this issue:

- It May Be Time to Dust Off Your HMDA Compliance

- Why Use a Certified Appellate Specialist?

- CA Supreme Court Refuses to Hear Default Interest Case

- Member Spotlight: Phil Goldstein

- Strictly Strickland: Running Your Business

Summer 2022

Inside this issue:

- BACK TO BASICS: How I Read a Commercial Appraisal

- The Payoff Scam Is Back!

- What Happens When Your Borrower and/or Investor Dies?

- Member Spotlight: Bob Spier

- Strictly Strickland: Setting Up a Trust Account Correctly

Spring 2022

Inside this issue:

- Cyber Insurance – What You Need to Know and Why

- Can an Owner Evict In California?

- California Court of Appeals Confirms that HOBR Violations Can Be Remedies Prior to Foreclosure

- MEMBER SPOTLIGHT: Richard Wachter

- Stricktly Strickland: The Minefields of DRE Audits

Summer 2021

Inside this issue:

- Deflating a Balloon Partial Payment Conundrum

- Everything You Want to Know About the New Auditor’s Report

- Eleventh Circuit Decision in Hunstein Places Debt Collection Business Models at Risk

- MEMBER SPOTLIGHT: Odell Murry

- Stricktly Strickland: DRE Broker Office Survey

Newsletter CONTRIBUTORS

Our Points of Interest writers and producers are professionals and experts in the private mortgage lending industry. Click on each contributors profile to learn more about them.

T. Robert Finlay, ESQ.

Attorney at Law

Wright, Finlay & Zak

Mayumi Bowers

Chief Operating Officer

Mortgage Vintage, Inc.

Michelle Rodriguez, Esq.

Attorney at Law

Wright, Finlay & Zak

Derrick Foote

Certified Public Accountant

Duner & Foote

Angelica Gardner, MBA

President

Asher Evan Investments

Arnold Graff

Attorney At Law

Wright, Finlay & Zak

Cathy Robinson

Attorney At Law

Wright, Finlay & Zak

David Herzer

President

Herzer Financial Services

Elizabeth Knight

President

PLM Lender Services

Joffrey Long

President

Southwestern Mortgage

Kevin Kim

Partner, Department Head Corporate and Securities

Geraci Law Firm

Nema Daghbandan

Partner, Department Head Banking and Finance

Geraci Law Firm

Michelle Mierzwa

Attorney At Law

Wright, Finlay & Zak

Todd Chvat

Attorney At Law

Wright, Finlay & Zak

Pam Strickland

Compliance Consultant

California Compliance Consulting

Dennis Doss

Attorney At Law

Doss Law

Henry Chavez

Principal

Spiegel Accountancy

PAST ISSUES

Spring 2021

Inside this issue:

- A “Wyatt” Standard for Insurance Brokers?

- Can Private Money Fuel the Recovery Once Again?

- Am I a “Debt Buyer?” Understanding the New Wave of Debt Buyer Statutes and Their Impact on Servicing Non-Performing Mortgage Debt

- MEMBER SPOTLIGHT: Donald Hensel

- Stricktly Strickland: Be Careful What You Say and How You Say It. Choose Your Words Carefully!

Winter 2020/21

Inside this issue:

- Assembly Bill 3088: How the California Lenders Dodged a Bullet

- Senate Bill 1079: California’s New Foreclosure and Post-Foreclosure Process

- What You Need to Know About ADUs in 2020

- Member Spotlight: Pam Sosa.

- Stricktly Strickland: DRE Audits and You – The Aftermath

fall 2020

Inside this issue:

- New Laws Impose Reporting and Written Notice Obligations on Employers Relating to COVID-19 Workplace Exposure

- Why COVID-19 is Making Collateral Certainty a Necessity for Closing Deals in Today’s Environment

- CMA Persuades Court to Publish Major Opinion on Forged Property Transfers

- Member Spotlight: Rory Cambra

- Stricktly Strickland: DRE Audits and You – Trust Accounts

Spring 2020

Inside this issue:

- Servicing Loans During the COVID-19 Outbreak: What Private Lenders Can and Cannot Do!

- The Current State of Data Privacy in the United States and Your Data Privacy Program

- Will Proposed Federal Laws Take Cannabis Lending to New “Highs”?

- Member Spotlight: Steve Belleville

- Strictly Strickland: DRE Audits and You – What Triggers It, What Happens Next

Winter 2019/20

Inside this issue:

- Tenant Protection Act of 2019 (AB 1482)

- Clarifying California’s Complex Usury Laws

- What’s the Difference Between an ALTA and CLTA Title Insurance Policy in California?

- Is Your Independent Contractor Now an Employee?

- Strictly Strickland: Advertising and Social Media – Are You and Your Agents Compliant?

Fall 2019

Inside this issue:

- Consumer Laws that Apply to Business Purpose Loans

- Rental Income: Passive v. Non-Passive

- Social Media Posting Plan & Tips

- Stricktly Strickland: DRE Special Investigations

Summer 2019

Inside this issue:

- Beyond the Basics of the California Consumer Privacy Act:

Unanticipated Challenges In Complying With the New Privacy California Law - If You Charge Default Interest, You’ll Want to Read This!

- New California Assembly Bill Adds Challenges for California Lenders

- California Court of Appeals Expands a Borrower’s Right to Attorneys’ Fees Under

HOBR: Hardie v. Nationstar - Stricktly Strickland: The Horror of a Hard-Money Audit

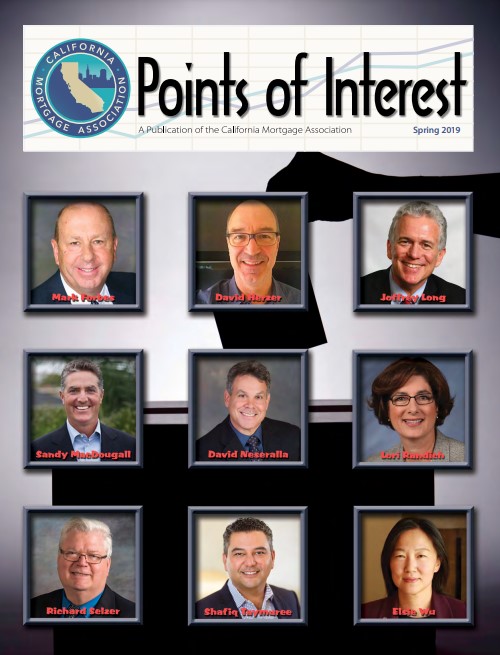

Spring 2019

Inside this issue:

- Ninth Circuit Expands Time for a Borrower to Sue to Enforce Rescission of a Loan Under TILA

- Robert Finlay Named California Mortgage Association General Counsel

- Priority of Liens 0n California Real Property

- What You Need to Know About Mortgage Funds

- Stricktly Strickland: DRE: This and That

Want to Write for Us?

We’re always looking for people to contribute ideas and write pieces for our newsletters. If you have ideas and expertise in the private mortgage industry, we want to hear from you. Fill out the form below and tell us a little about yourself.